CitiMortgage (a SmartAsset advertising partner), headquartered in St. Louis, was founded in 1979. While the company has historically originated home loans as well as serviced them, in 2017, it announced it would no longer service home loans. Instead, CitiMortgage will originate loans then sell the existing mortgage to another company for servicing. This is a common practice among mortgage lenders.

CitiMortgage is part of Citigroup, one of the so-called big four banks in the U.S., alongside JPMorgan Chase, Bank of America and Wells Fargo. Citigroup’s history stems back to 1812 when City Bank of New York, the predecessor of Citibank, was founded. Citigroup provides banking, insurance, asset management, credit cards, consumer, investment and corporate banking, financial services, foreign currency exchange, private banking and equity, wealth management and mortgage loans.

Today's Rates

| Product | Today | Last Week | Change |

|---|---|---|---|

| 30 year fixed | 5.75% | 5.88% | -0.13 |

| 15 year fixed | 5.25% | 5.44% | -0.19 |

| 5/1 ARM | 6.06% | 6.06% | 0.00 |

| 30 yr fixed mtg refi | 7.21% | 7.13% | +0.08 |

| 15 yr fixed mtg refi | 6.59% | 6.73% | -0.14 |

| 7/1 ARM refi | 6.13% | 6.13% | 0.00 |

| 15 yr jumbo fixed mtg refi | 3.06% | 3.10% | -0.04 |

National Mortgage Rates

Regions Served by CitiMortgage

Does CitiMortgage Operate in My Area?

CitiMortgage originates loans in all 50 states.

What Kind of Mortgage Can I Get With CitiMortgage?

CitiMortgage offers plenty of home loan options, including fixed-rate or adjustable-rate mortgages and government-backed loans like FHA and VA loans.

Fixed-rate mortgage: This loan option is available in 10-year, 15-year and 30-year terms. The 30-year fixed-rate mortgage is the most popular mortgage option for buyers in the U.S., according to Freddie Mac. With a fixed-rate mortgage, the interest rate remains the same for the life of the loan, meaning your monthly payments stay the same for the life of the loan.

Adjustable-rate mortgage (ARM): An ARM stands in contrast to a fixed-rate mortgage in that the interest rate attached to the loan can fluctuate over the loan’s life. In general, the interest rate is lower for an introductory period than it would be with a fixed-rate loan. Once that period of time has ended, the interest rate can increase or decrease once a year. An ARM may be a good option for you if you only plan to stay in the home for a few years.

Federal Housing Administration (FHA loan): This is a government-insured loan which is available as either a fixed-rate or adjustable-rate mortgage. If you have limited income, a low credit score, less than 20% for a down payment, a limited employment history or are self-employed, this may be a smart option for you.

VA loan: The benefits of this loan, which is guaranteed by the Department of Veterans Affairs, include no down payment requirements, competitive interest rates and low closing costs and fees. If you are a current or former member of the U.S. Armed Forces or National Guard (or spouse of one), you may be eligible for this mortgage.

Jumbo loan: This type of loan is typically used to buy an expensive home. The loan amount has to exceed the conforming loan limit for it to be considered a jumbo loan. In most of the U.S., the conforming loan limit is $726,200, but in certain high-cost counties, that limit could be higher. A jumbo loan has a higher interest rate, may require a larger down payment and a lower loan-to-value ratio than conventional mortgages. Jumbo loans are available as fixed-rate or adjustable-rate mortgages.

HomeRun Mortgage: Citi offers mortgage programs for low or moderate income borrowers. The HomeRun program is available to you if you earn 80% or less than the area median income (and in some cases, regardless of area income). With interest rates comparable to conventional loans, a down payment as low as 3% and no mortgage insurance requirement, this is an attractive option. A HomeRun mortgage is fixed-rate, can be as high as the conventional loan limit ($726,200 in most areas), requires homeownership education and has flexible credit guidelines.

Refinance: You can choose to refinance your mortgage with CitiMortgage. In general, you can choose from a fixed-rate or ARM loan. As with any refinance, you’ll have to pay closing costs, which may not make it the best financial choice in all cases.

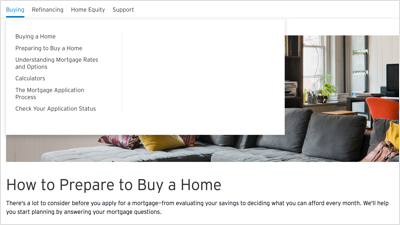

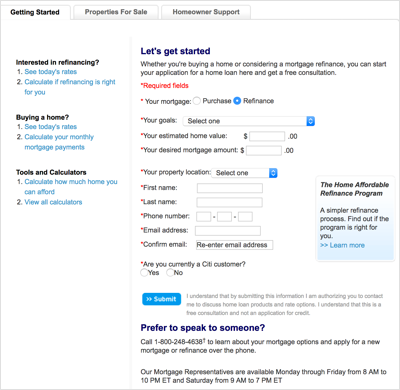

What Can You Do Online With CitiMortgage?

This lender keeps things basic. You can find a few bare-bones online features, such as current mortgage rates and information about the application process, but that’s about it. If you want to see mortgage rates for all the loan options, rather than just 30-year fixed-rate, you’ll need to input information about the property including residence type, city, state, county and credit score range. You can’t skip the county requirement or any of the fields to get to the rates results.

While you can apply for a mortgage online, you don’t have the option to apply for preapproval or prequalification. If you have any questions, you’re prompted to call a mortgage representative. There’s no live chat option.

You also won’t find a mobile experience with CitiMortgage. Citibank does have online banking, but that doesn’t extend to the mortgage division. If you try to use the CitiMortgage website on your mobile device, it’s not responsive or mobile-optimized. That means if you want to apply online, you’re best served by using a desktop or through calling a mortgage representative or applying in-person.

Would You Qualify for a Mortgage From CitiMortgage?

As a larger bank, CitiMortgage has more flexible lending standards than a smaller lender. That means if you have a FICO credit score of 620 (generally the lowest most lenders accept) or below, you still might qualify for a CitiMortgage FHA loan or HomeRun loan. You also might qualify for a loan with untraditional work history, something that’s hard to do with many smaller lenders that require a solid two years of W-4s and pay stubs. That means if you’re a freelancer, you may have an easier time qualifying for a mortgage if you choose this lender.

When it comes to down payment savings, the general rule of thumb is 20%. However, CitiMortgage offers options that require much less. VA loans require $0 down, the HomeRun loan requires 3% and FHA loans generally can have as little as 3% (but you’ll pay a version of private mortgage insurance). That means if you don’t have the traditional down payment savings, you could still qualify for a home loan.

Another mortgage qualification factor is your debt-to-income ratio (or DTI). This percentage is used to determine whether you can afford a monthly mortgage payment. While it’s best to have a debt-to-income ratio of 36% or less, CitiMortgage can generally offer home loans to those with up to 43%.

Find your DTI by calculating your monthly debt payments and dividing by your pre-tax monthly income. Total your student loans, credit card payments, auto loan and other monthly debt and then divide by your monthly, pre-tax income. Multiple that number by 100 to find your percentage.

What’s the Process for Getting a Mortgage With CitiMortgage?

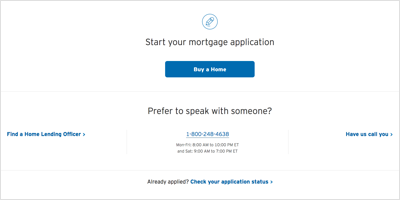

You can apply for a mortgage with Citi with the online application, over the phone and in person. If you choose an online application, you’ll create an online profile to track your loan application. Citi estimates that the application takes about 30 minutes or more. You’ll need to provide information about the property, your contact details and financial information.

The documents you need include W-2s, pay stubs, federal tax returns and employment history for the past two years, bank and asset statements for the last two months and a canceled rent check or other form of rent verification (if applicable).

If you are self-employed, you may need a current profit and loss statement as well. If you’re applying for a VA loan, you will have to show your VA certificate of eligibility. You may also need an explanation of late payments on your credit report, proof of alimony or child support and a copy of your divorce decree if those situations apply to you.

After your online application is started, you’ll be contacted by one of CitiMortgage’s consultants for a free assessment of your loan needs and options, and may be given preapproval. According to Citi’s page on the mortgage application process, you’ll get a loan estimate within three days of the loan application.

Before final approval, CitiMortgage will order a home appraisal to get the property’s estimated market value. The appraised value helps determine the mortgage amount and terms.

How CitiMortgage Stacks Up

CitiMortgage offers many of the home loan options you find at similar sized large banks, such as Wells Fargo and U.S. Bank. However, CitiMortgage doesn’t offer USDA loans. While Citi customers can take advantage of having all banking concerns as well as their mortgage in one spot, once the loan goes through, it’ll be serviced by an outside company, not Citi.

Other than having a wide reach - CitiMortgage is available in all 50 states - the company doesn’t offer much in terms of online user-friendliness for its customers. For example, the website lacks a live chat feature. It can be a challenge to find the answers to questions you may have online. There also isn’t a mobile-friendly version of the website, nor is there an app (the Citi app is for general banking, not the mortgage division).

On the website itself, you can’t pre-qualify or get preapproved for a mortgage. Your only option is to call an agent or to start an actual mortgage application. Fortunately, the company does have extensive phone hours, offering support Monday through Friday, 8 a.m. to 10 p.m. and Saturday 8 a.m. to 6 p.m. Eastern time. If you’re looking for an easier online experience, you may want to consider Rocket Mortgage (Quicken Loan’s online-based mortgage service), PNC Mortgage or Better Mortgage.

Tips for Finding a Mortgage

- There can seem to be an endless sea of loan options when you're mortgage hunting, but there is one thing to look for if you find two similar lenders. While interest rates are flat, annual percentage rates (APRs) include outside charges, like closing costs and other fees. So if one lender has a larger difference between their interest rates and APRs than another, you may want to choose the one with presumably lower fees.

- A financial advisor can help you choose a mortgage that fits into your financial plan. SmartAsset free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.