Chase is one of the top mortgage lenders in the U.S. Each year, Chase originates many home loans, ranking its mortgage business among the likes of Wells Fargo, Quicken Loans and Bank of America. Chase offers all major mortgage types, including fixed-rate, variable-rate, jumbo, FHA, VA and a low-income and low-down-payment option called the DreaMaker® Mortgage.

In addition to mortgages, Chase, headquartered in New York, offers retail banking, credit cards, auto loans, investment and corporate banking, investment services and commercial banking. Chase is publicly traded under the stock symbol JPM on the New York Stock Exchange.

Does Chase Operate in My Area?

Chase originates loans in all 50 states. You can connect with one of their home lending advisors in Washington, D.C. and the following 38 states: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, West Virginia and Wisconsin.

Today's Rates

| Product | Today | Last Week | Change |

|---|---|---|---|

| 30 year fixed | 5.75% | 5.88% | -0.13 |

| 15 year fixed | 5.25% | 5.44% | -0.19 |

| 5/1 ARM | 6.06% | 6.06% | 0.00 |

| 30 yr fixed mtg refi | 7.21% | 7.13% | +0.08 |

| 15 yr fixed mtg refi | 6.59% | 6.73% | -0.14 |

| 7/1 ARM refi | 6.13% | 6.13% | 0.00 |

| 15 yr jumbo fixed mtg refi | 3.06% | 3.10% | -0.04 |

National Mortgage Rates

Regions Served by Chase

What Kind of Mortgage Can I Get With Chase?

You have a number of mortgage loan options at Chase:

DreaMaker® mortgage: Homebuyers with limited income are the target demographic for this mortgage option. It’s a 30-year fixed-rate loan that requires as little as 3% down payment, which can come from a gift or grant. The DreaMaker® Mortgage has reduced mortgage insurance requirements, flexible closing costs funding options and lower monthly payments.

Fixed-rate loan: This interest rate will stay the same for the entire life of this loan. Spreading out your monthly payments over a long period of time can result in lower payments. Chase offers fixed-rate mortgages with 10-year, 15-year, 20-year, 25-year and 30-year terms.

Adjustable-rate mortgage (ARM): With this mortgage, you can expect to have a lower interest rate as compared to a fixed-rate mortgage for the first five, seven or 10 years. Once that period ends, however, the interest rate can change once a year and it will usually but not always increase. If you plan to only stay in your new home for a few years, this may be an option that you want to look into.

FHA loan: This is Federal Housing Administration-backed home loan with down payments as low as 3.5%. Unlike many other loans, you can use funds that were gifted to you as a down payment. It’s available in fixed terms of 15-year, 20-year, 25-year or 30-year options at Chase.

VA loan: This may be a great choice if you are a current or former member of the U.S. Armed Forces or National Guard (or the spouse of one). These loans are backed by the Department of Veterans Affairs and some of the benefits include lower down payment requirements, no monthly mortgage insurance required and 100% financing. VA loans are available in fixed-rate mortgages from 10 to 30 years.

Jumbo loan: A jumbo loan is one that exceeds the conforming loan limit in a particular county. At Chase, it’s available for amounts up to $9.5 million, but borrowers must meet post-closing asset requirements for amounts over $3 million. If you decide on a jumbo loan, be aware that it is usually accompanied by a higher interest rate to make up for the added risk on the part of the lender. In general, any loan over the conventional limits of $726,200 or $1,089,300 (depending on the county) is considered a jumbo loan.

Refinance: You can opt to refinance a mortgage through Chase. Your refinance options are the same as most of the loan options, including fixed-rate, adjustable-rate, FHA and VA loans.

What Can You Do Online With Chase?

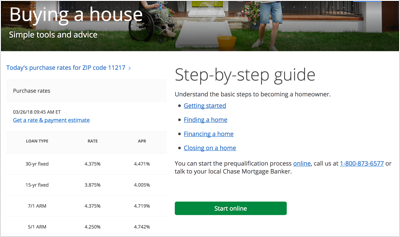

Chase has a simple, cleanly designed mortgage website. You can find all the main pieces of information relatively easily, including mortgage tools and tips, loan rates, contact information and mortgage prequalification.

The prequalification application doesn’t give you an estimated time until completion, something that Bank of America or Better Mortgage provides, but it’s a straightforward process. After prequalification, you can apply for your loan entirely online.

As for the tools, resources and rates, you can find the current rates offered, information about each type of loan both in blog article format as well as video. This is one of the few mortgage lenders that offers video answers for many common mortgage questions.

What you won’t find on Chase online is a chat function. This can be helpful if you need a quick question answered and you don’t want to call the company. There also isn’t a great mobile experience. If you try to prequalify on your phone, the screen is much too small to be seen. The site is not as responsive as it could be, especially when compared to newer mortgage companies, such as Lenda.

The mobile app is fine for Chase Bank customers, but the only mortgage functionality is allowing you to monitor and pay your mortgage online once you already have a loan. You can’t apply or manage your application through the app.

Would You Qualify for a Mortgage From Chase?

Chase doesn’t have an explicit credit score requirement, but in general, you’ll need about a 620 FICO score or higher to be considered for a mortgage. Keep in mind that to qualify for the best interest rate, the higher your credit score the better.

Besides your credit score, Chase will consider your income and work history, down payment savings and debt-to-income ratio. For down payment savings, your best bet is to aim for 20% of the home price. That amount helps you get the lowest interest rates, eliminates the need for private mortgage insurance and provides you with 20% equity in your home immediately. Now, if you’re applying for the DreaMaker® Mortgage, FHA or a VA loan, you won’t need 20%. But in general, putting 20% down is the most favorable route to homeownership.

Your debt-to-income ratio (DTI) is an important factor during the application process. This percentage helps your mortgage lender understand your ability to pay your monthly loan payments. In general, most lenders look for 36% or less for the most favorable loan terms. For some loans, they can go up to 44% or so, dependant on your full financial situation.

To calculate your DTI, total your monthly debt payments. Debt includes your student loans, credit card payments, auto loans, child support, etc. Next, divide your monthly debt liabilities by your pre-tax monthly income and multiple by 100 to find your percentage.

What’s the Process for Getting a Mortgage With Chase?

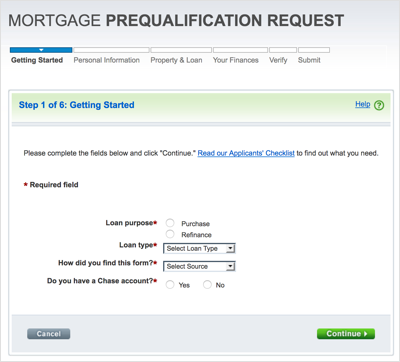

One of the first steps you can take is to apply for prequalification online. If you’d rather speak to someone, you can call or meet with a lending specialist in person. After your initial contact with Chase, you’ll be assigned a mortgage representative to guide you through the loan application process.

The online prequalification has a checklist to help you with document requirements. Information you’ll need includes personal contact info, total yearly income, value of assets you own, property type, purchase price and down payment, estimated annual taxes and insurance and name and number of your real estate agent.

Once you move from prequalification to the actual application, you’ll need to verify the information you provided with actual proof. That means identification, tax returns, proof of employment (pay stubs and W-2s), bank information to verify assets, the offer you made on the home, along with any additional paperwork your mortgage agent requests. After your information is reviewed, you’ll receive a loan estimate that outlines your loan terms and fees. Your interest rate, payments and other important information (such as disclosures) are all included in this document. If you’re satisfied, you can move forward with the loan.

Before you close on the home, you’ll need to arrange for a home inspection and the bank will send an appraiser as a final step. If everything checks out, the final steps are arranging for homeowners insurance. Most borrowers use an escrow account. This account is maintained by the lender and will pay out your insurance and property taxes. The money comes from your monthly payments that include principal, interest, taxes and insurance.

How Chase Mortgage Stacks Up

As one of the most prolific mortgage lenders in the U.S., Chase is a good option for many home buyers. There are plenty of loan options to choose from and in general, the bank offers competitive rates. You can prequalify and apply online, or meet in person or speak on the phone. That said, the best customer is likely someone who already banks with Chase. It can be preferable to keep all accounts in one place, as long as you’re happy with the loan terms you’re offered.

The advice is similar to what SmartAsset says for the other three large banks (Bank of America, Wells Fargo and Citi). You’ll find very similar mortgage products across all four, similar rates and similar online experiences and not many glaring detractors.

If you’re looking for an online-optimized mortgage, you could try an internet-based lender, such as Rocket Mortgage, Ally or Better. You won’t find in-person locations where you can sit down with an advisor, but you’ll be impressed by the online experience with these digital-based lenders.

Ultimately, it’s up to you and your needs and preferences. If you’d rather keep all banking in one place, Chase might be for you. If you’d rather shop around for the best terms, rates and digital experience, you have plenty of mortgage lenders to choose from.

Tips to Narrow Down Your Mortgage Options

- Mortgages quickly become more understandable if you can take the time to figure out how long you want to live in your new home. By acknowledging that this will likely be either a long- or short-term committment, you'll find that a fixed-rate or adjustable-rate mortgage, respectively, would better suit you.

- A financial advisor can help you choose a mortgage that fits into your financial plan. SmartAsset free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.