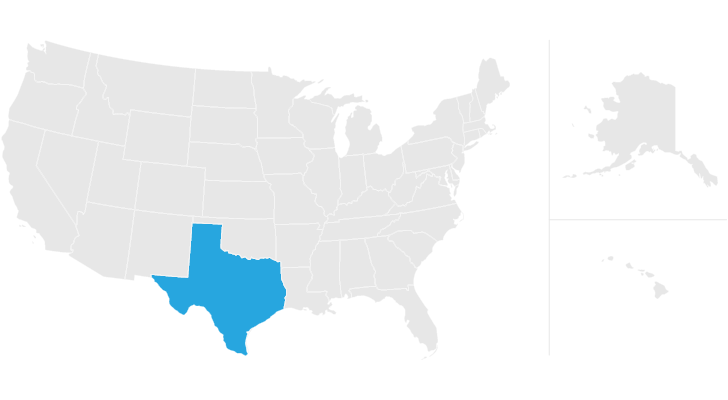

The state of Texas does not have an estate tax, however residents may still be subject to federal estate tax laws. If you live in Texas and are thinking about estate planning, this guide will walk you through what you need to know. If you think you need help with estate planning or general financial planning, you may want to consider getting a financial advisor. SmartAsset’s free matching tool can help you find a financial advisor in your area that’s a good fit for you.

Texas Estate Tax

Texas does not levy an estate tax. It is one of 38 states with no estate tax.

What Is the Estate Tax?

The estate tax, sometimes referred to as the “death tax,” is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. It only applies to estates that reach a certain threshold.

The estate tax is different from the inheritance tax, which is taken by the government after money or possessions have been passed on to the deceased person’s heirs.

Texas Inheritance Tax and Gift Tax

There is also no inheritance tax in Texas. However other states’ inheritance taxes may apply to you if a loved one who lives in those states gives you money, so make sure to check that state’s laws. For example, in Pennsylvania, there is a tax that applies to out-of-state inheritors. If you have a loved one who dies in Pennsylvania and leaves you money, you may owe taxes to that state.

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2022 is $16,000 per year per recipient, increasing to $17,000 in 2023. Gifting more than that to any individual person in a single year means that the amount over the limit counts against your lifetime exemption of $12.92 million.

Federal Estate Tax

Regardless of the size of your estate, you won’t owe estate taxes to the state of Texas. You might owe money to the federal government, though. The federal estate tax only kicks in at $12.06 million for deaths in 2022 and $12.92 million in 2023. In other words, if an estate surpasses that number, any value above that mark is subject to the estate tax. Estates worth less than that pay nothing to the federal government.

This tax is portable for married couples. This means that if the right legal steps are taken, a married couple’s estate won’t have to pay a tax on up to $25.84 million when both spouses die. If an estate exceeds that amount, the top federal tax rate is 40%.

Here’s an example of how to calculate the federal estate tax:

Let’s say your estate is worth $16.22 million and you don’t have a spouse. Subtracting the 2022 exemption of $12.92 million, you have a taxable estate of $3.3 million. Consulting the chart above, you’re in the highest bracket. Your base payment on the first $1 million is $345,800. You also pay 40% on the remaining $2.3 million, which comes to $920,000. That, plus the base of $345,800, means your total tax burden is $1,265,800.

Federal Estate Tax Rates

| Taxable Estate* | Base Taxes Paid | Marginal Rate | Rate Threshold** |

| $1 – $10,000 | $0 | 18% | $1 |

| $10,001 – $20,000 | $1,800 | 20% | $10,001 |

| $20,001 – $40,000 | $3,800 | 22% | $20,001 |

| $40,001 – $60,000 | $8,200 | 24% | $40,001 |

| $60,001 – $80,000 | $13,000 | 26% | $60,001 |

| $80,001 – $100,000 | $18,200 | 28% | $80,001 |

| $100,001 – $150,000 | $23,800 | 30% | $100,001 |

| $150,001 – $250,000 | $38,800 | 32% | $150,001 |

| $250,001 – $500,000 | $70,800 | 34% | $250,001 |

| $500,001 – $750,000 | $155,800 | 37% | $500,001 |

| $750,001 – $1,000,000 | $248,300 | 39% | $750,001 |

| Over $1,000,000 | $345,800 | 40% | $1,000,001 |

*The taxable estate is the total above the federal exemption of $12.92 million.

**The rate threshold is the point at which the marginal estate tax rate kicks in.

Overall Texas Tax Picture

Texas is a very tax-friendly state, especially for retirees. There’s no state income tax in Texas, so there won’t be taxes on Social Security and other retirement income. Keep in mind that you’ll still be paying federal income tax. However, not owing any money to the state can be a relief, especially for those on a specific income in retirement.

Property tax, though, is a different story. The state has some of the highest property taxes in the country. The property tax in Texas averages an effective rate of 1.60%, which is one of the nation’s highest marks. Finally, the state sales tax base is 6.25%, but with local taxes the average sales tax is 8.2%.

Estate Planning Tips

- If you’re planning an estate or just looking to get help with financial planning in general, a financial advisor can be a big help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- When planning an estate, it is important to know everything you have in your portfolio, including any retirement accounts. This 401(k) calculator can show you what your account might be like when you’re ready to go into your golden years.

- Planning an estate is not just for the old. In fact, you should start thinking about your estate plan when you’re younger, so that you will be prepared as you move into your later years.

Photo credits: ©iStock.com/mediaphotos, SmartAsset, ©iStock.com/RoschetzkyIstockPhoto