Posts by Amelia Josephson

What Is the Average Monthly Retirement Income?

Wondering how your retirement savings stack up to other Americans’ nest eggs? Or whether your income in your post-work years will be enough to keep you afloat? It’s normal to be curious about the average retirement income in the U.S.… read more…

Tax Loopholes That Could Save You Money

A tax loophole is a tax law provision or a shortcoming of legislation that allows individuals and companies to lower tax liability. Loopholes are legal and allow income or assets to be moved with the purpose of avoiding taxes. This… read more…

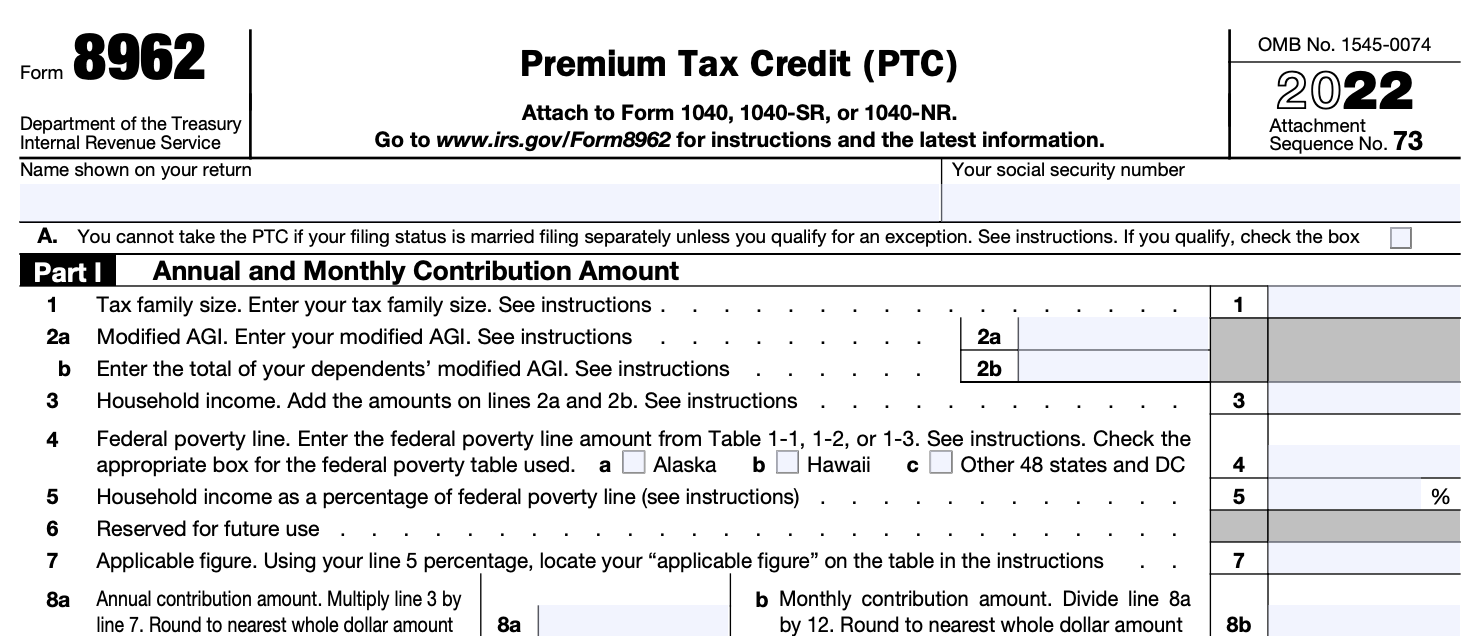

All About IRS Form 8962 and Calculating Your Premium Tax Credit

With Form 8962, you are reconciling the tax credit you are entitled to with any advance credit payments (or subsidies) for the tax year. The size of your tax credit depends on the cost of available health insurance, your family… read more…

All About IRS Form 2441

Hiring someone to care for your loved one so you can continue working is a common practice in the U.S. If a child, spouse or other household member requires care and you can’t provide the care without quitting your job,… read more…

The Average Salary by Age in the U.S. – Are You Making What You Should Be?

The answer to how your earnings compare to others in your age group largely depends on where you live and what you do. But knowing the median salary of people the same age can tell you if you’re generally keeping… read more…

Explaining Changes to the State and Local Tax Deduction

The state and local tax (SALT) deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The tax plan signed by President Trump in 2017, called the Tax Cuts and Jobs Act, instituted a… read more…

What Is a Good P/E Ratio? Is High or Low Better?

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors. The… read more…

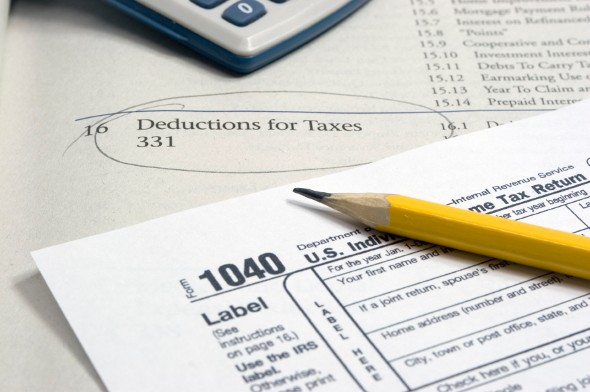

What Can You Deduct at Tax Time?

Knowing what you can deduct when you’re doing your taxes each year is important if you want to reduce your tax liability. Some common deductions, like the mortgage interest tax deduction, are well known, but if you’re going to do… read more…

A Guide to the Federal Estate Tax for 2024

An estate tax is most notably levied at the federal level, and it’s charged to a decedent’s estate when their assets pass on to their beneficiaries. Most estates won’t trigger the federal estate tax though, as it only applies to estates… read more…

What Is a Roth IRA?

A Roth IRA is an individual retirement account funded with after-tax dollars. You can’t deduct contributions to a Roth IRA at tax time, but you can withdraw your money tax-free in retirement. A Roth IRA is a popular choice for… read more…

A Guide to 401(k) Hardship Withdrawals

A 401(k) hardship withdrawal is the action of taking money out of your workplace retirement plan early to deal with a life event that requires some money. You typically can’t withdraw money from your account until you reach age 59.5 –… read more…

What Is a Spousal IRA?

We all know that saving for retirement is a good thing. We often think of retirement savings in terms of a percentage of our paychecks, but what about when someone doesn’t work? The IRS has a solution that allows a… read more…

The Dos and Don’ts of Borrowing Money

Taking on debt is a thorny subject. Signing on an affordable mortgage is one thing. Racking up credit card debt on unnecessary purchases? Quite another. Any time you borrow money, you put your finances at risk. That’s why it’s important to… read more…

What Is a Clawback?

A clawback is the legally required return of incentive compensation such as a bonus or stock grant. Once applicable only to top company officers, clawback provisions are appearing in more employment contracts, particularly in the financial services industry. If your contract… read more…

A Guide to Commercial Real Estate Loans

A commercial real estate loan, also known as a business mortgage, is a loan for property used for commercial purposes. The collateral for the mortgage can partially be the building itself, whether that’s an office, retail space, apartment building, warehouse or other development.… read more…

A Guide to 457(b) Retirement Plans

A 457(b) plan is an employer-sponsored, tax-deferred retirement savings vehicle available to some state and local government employees. It works like a 401(k) in that employees can divert a portion of their pay to their retirement account. This provides an immediate tax… read more…

How Do Bond Loans Work?

Low- and middle-income families who want to buy homes may be able to get a bond loan. State and local authorities issue bond loans to subsidize the cost of becoming a homeowner for those who meet certain income requirements, either… read more…

A Guide to Investing for Beginners

While saving is the first step to building wealth, putting your savings to work through investing is typically the first step to growing that wealth. While stocks are usually the first thing people think to invest in, you can also… read more…

Your Mortgage Preapproval Checklist

To get preapproved for a mortgage, you’ll need a few documents detailing your income, assets and debt obligations. This helps banks and other mortgagees determine exactly how much they’re willing to lend you. Getting mortgage preapproval also helps you understand… read more…

What Is a Leveraged ETF?

Exchange-traded funds, or ETFs, are popular investment securities that track stock market indexes, a particular commodity, bonds, or a particular category of assets like tech stocks. A leveraged ETF is a particular type of ETF that uses debt or financial… read more…

IRA Withdrawal Rules

When you’re ready to take withdrawals from your IRA, you’ll find there are plenty of rules to follow. Failure to stick to these guidelines could have serious ramifications. The most notable among these is a 10% penalty tax on IRA withdrawals made before age 59.5. Beware, though, as traditional and Roth IRAs have two distinct… read more…

How to Make Withdrawals From Your 401(k)

Regardless of when you do it, making a withdrawal from your 401(k) involves following a handful of rules. That’s because you’re tapping your tax-deferred retirement savings, which means the IRS keeps a close eye on it. During retirement, these withdrawals are also known as distributions. Perhaps the most important age when it comes to 401(k)… read more…

What Is a Non-Deductible IRA? Definition and Contribution Limits

A nondeductible IRA is a retirement plan you fund with after-tax dollars. You can’t deduct contributions from your income taxes as you would with a traditional IRA. However, your non-deductible contributions grow tax-free. Many people turn to these options because… read more…

Mortgage Protection Life Insurance

So you took the plunge and bought a house, with a mortgage to match. You may be wondering if you need life insurance to cover the mortgage in case something happens to you before it’s paid off. Without life insurance,… read more…

What Is a Tax Abatement?

If you’re considering buying a new home, a tax abatement may provide an incentive that’s hard to pass up. These beneficial tax programs allow for a long-term break on your property tax bill. Savings like that will undoubtedly impact your bottom… read more…